Click Here for the Best Credit Counselling Singapore Provides

Click Here for the Best Credit Counselling Singapore Provides

Blog Article

Just How Credit Scores Coaching Can Change Your Financial Future: Methods for Getting Stability

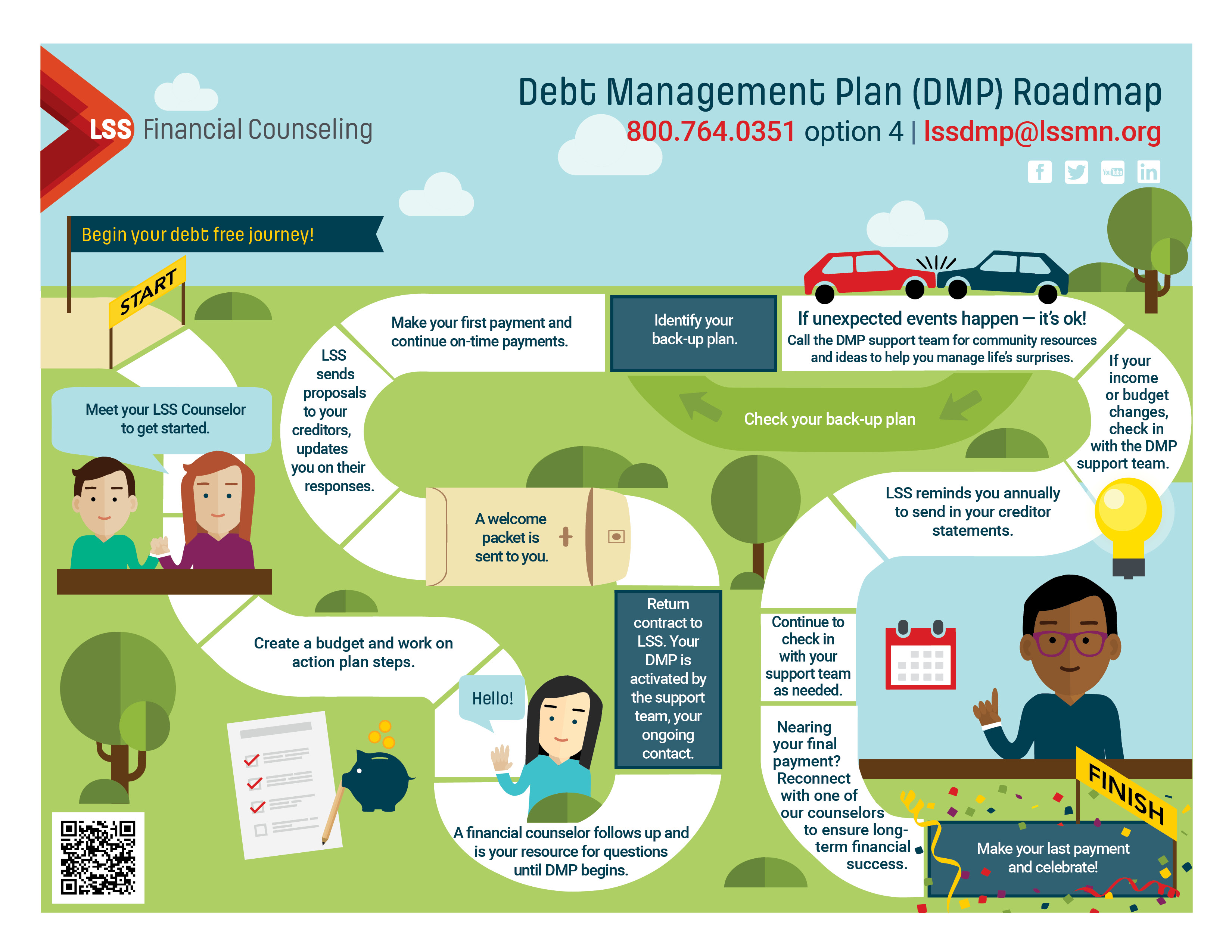

Credit history counselling presents a structured method to financial monitoring, supplying people the tools necessary for lasting financial stability. By involving with a specialist counsellor, clients can uncover customized methods that address their unique economic obstacles, from budgeting to financial obligation reduction. This guidance not just clears up the often-complex landscape of credit report however also empowers people to take aggressive actions toward their financial objectives. However, the trip to monetary security includes more than simply initial methods; it calls for recurring commitment and understanding of the wider ramifications of monetary choices. What are the important elements that make sure long lasting success in this undertaking?

Understanding Credit Report Counselling

Counselling sessions commonly cover important subjects such as recognizing debt reports, identifying the effects of various debt types, and determining efficient settlement approaches. By fostering an informed perspective, credit report counselling helps people make audio economic choices.

The goal of credit history therapy is to furnish people with the tools required to navigate their monetary circumstances successfully. As a positive action, it urges customers to adopt healthier monetary habits and impart a feeling of liability. Inevitably, credit history therapy offers not only as a method of resolving instant economic issues yet likewise as a foundation for long-term economic health.

Benefits of Credit Score Therapy

Engaging in credit history coaching uses various advantages that expand beyond immediate financial debt relief. One of the key benefits is the development of an individualized monetary strategy tailored to an individual's one-of-a-kind conditions. This strategy frequently consists of budgeting methods and strategies to manage costs better, fostering economic literacy and technique.

Furthermore, credit scores coaching offers accessibility to qualified specialists who can use professional recommendations, helping people recognize their credit report reports and scores. This expertise empowers clients to make enlightened decisions regarding their funds and promotes liable credit scores use in the future.

Another considerable advantage is the possibility for reduced rates of interest or worked out negotiations with creditors. Credit score counsellors frequently have developed partnerships with lenders, which can result in a lot more positive terms for customers, easing the burden of payment.

Furthermore, debt counselling can play an important function in psychological health. By resolving financial issues proactively, individuals can reduce tension and stress and anxiety connected with overwhelming financial obligation, causing an enhanced general high quality of life.

Eventually, credit report therapy not just aids in achieving short-term financial alleviation yet additionally furnishes individuals with the tools and knowledge necessary for long-term economic security and success.

Secret Techniques for Success

Achieving financial security calls for a calculated method that encompasses various crucial elements. First, it is necessary to create a thorough spending plan that precisely reflects revenue, costs, and cost savings goals. This spending plan works as a roadmap for managing funds and enables people to determine areas for renovation.

Second, great site focusing on financial obligation repayment is crucial. Approaches such as the snowball or avalanche techniques can effectively minimize financial debt worries. The snowball method focuses on paying off smaller sized financial obligations first, while the avalanche technique targets higher-interest debts to decrease general passion expenses.

In addition, developing a reserve is important for economic safety and security. Alloting 3 to 6 months' worth of living expenditures can offer a buffer against unpredicted situations, lowering reliance on credit.

Additionally, continual financial education and learning plays a substantial role in successful credit report therapy. Remaining educated about monetary items, passion prices, and market trends equips people to make far better economic decisions.

Choosing the Right Counsellor

Selecting a competent credit counsellor is a crucial action in the trip toward monetary stability. Begin by researching counsellors connected with trustworthy companies, such as the National Structure for Credit Score Therapy (NFCC) or the Financial Counseling Association of America (FCAA)

Following, examine the counsellor's credentials and experience. Look for certified specialists with a strong record in credit scores counselling, financial debt administration, and financial education and learning. It is crucial that the counsellor shows an extensive understanding of your specific requirements and difficulties.

Additionally, consider their technique to counselling. An excellent credit score counsellor ought to prioritize your financial objectives and offer individualized techniques instead of one-size-fits-all options. Schedule a first assessment to determine exactly how comfy you feel reviewing your financial circumstance and whether the counsellor's communication style aligns with your assumptions.

Lastly, ask about costs and services provided. Openness in costs and a clear understanding of what to anticipate from the counselling process are crucial in establishing a relying on partnership.

Keeping Financial Security

Maintaining monetary security calls for ongoing dedication and aggressive management of your monetary sources. This involves regularly examining your income, expenses, and cost savings to make sure that your economic methods line up with your long-lasting goals. Establishing a thorough budget plan is a foundational step; it provides a clear image of your monetary wellness and enables you to identify locations where adjustments may be needed.

Furthermore, producing a reserve can act as a financial buffer against unanticipated expenditures, thereby avoiding dependence on credit scores. Goal to save at the very least 3 to six months' well worth of living expenditures to enhance your financial safety and security. Frequently examining and changing your investing routines will likewise cultivate technique and liability.

In addition, monitoring your debt report and resolving any type of disparities can significantly influence your economic stability. A healthy credit history not just opens up doors for far better financing terms but additionally reflects responsible economic actions.

Final Thought

In recap, credit report counselling works as a crucial resource for people seeking to enhance their monetary security. By offering customized approaches and professional guidance, it fosters a much deeper understanding of budgeting, financial obligation management, and credit scores understanding. credit counselling services with EDUdebt. Implementing the methods learned through therapy can bring about reduced financial tension and raised confidence in handling personal financial resources. Eventually, the transformative possibility of credit history therapy lies in its capacity to outfit people with the devices needed for lasting monetary success.

The trip to click to find out more economic stability involves even more than just first techniques; it calls for ongoing commitment and understanding of the more comprehensive ramifications of economic decisions.The goal browse this site of credit counselling is to furnish individuals with the tools required to browse their economic situations efficiently. Inevitably, debt counselling offers not just as a method of attending to prompt monetary worries yet also as a foundation for long-lasting monetary wellness.

Keeping economic stability calls for ongoing commitment and proactive administration of your monetary sources.In summary, debt coaching serves as an essential source for people looking for to improve their financial stability.

Report this page